Underwriting and Sales of SDG Bonds (Green Bonds, Social Bonds, etc)

Nomura Holdings, Inc.

Outline

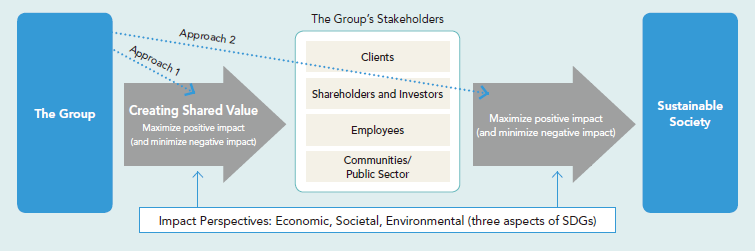

Nomura Group is actively working to ensure healthy development of sustainable finance markets in Japan and overseas. In order to support sustainable finance globally, Nomura Group established an expert team within the Wholesale Division that underwrites SDG bonds (Generic term for green bonds, social bonds, sustainability bonds, etc.). In 2019, Nomura Securities Co. Ltd. (Hereinafter, “Nomura Securities”) was the only Japanese firm elected into the Green Bond Principles and Social Bond Principles Advisory Council of the International Capital Market Association. Also, Nomura Securities has been involved in the initiative to create international standards for SDG bonds. Nomura Group considers ESG/SDGs as an important management theme. As a mediator, who connects issuers that incorporate ESG/SDGs into their financing activities with investors that takes ESG/SDGs into account when making investment decisions, Nomura Group will continue to support the healthy development of sustainable finance markets and contribute to the realization of sustainable economic growth and the sustainable development of society.

Description

Due to growing recognition of ESG investments and the United Nations’ Sustainable Development Goals (SDGs), green bonds, social bonds, and sustainability bonds (hereinafter collectively referred to as "SDG bonds"), which aim to cope with environmental and social issues, have attracted attention on a global scale.

Through underwriting and distribution of SDG bonds, Nomura Group bridges issuers’ demand to tackle climate change/social issues and investors’ demand to contribute to society through investment. Specifically, Wholesale Division’s Investment Banking business established an ESG bond expert team in Japan in 2017, and the team evolved into a global team in the following year to support the structuring of sustainable finance projects both in Japan and overseas. In October 2019, Nomura Securities Co., Ltd. (Hereinafter, “Nomura Securities”) was elected into Green Bond Principles Social Bond Advisory Council of the International Capital Market Association as the only Japanese company. Also, Nomura Securities has been involved in the initiative to create international standards for SDG bonds.

Under the mission to enrich society through its expertise in capital markets, Nomura Group will continuously provide underwriting and advisory services related to SDG bonds to support companies in contributing to sustainable development of society and to enhance global sustainable finance market.

The following examples are some of the recent sustainable finance deals underwritten by Nomura Group.

"Obayashi Green Bond" (Issued in October 2018) is the first green bond issued by a construction company in October 2018. Funds raised are being used to finance renewable energy projects and green buildings, as well as construction of SEPs (Self-Elevating Platform) which are essential for offshore wind farm construction, enabling the construction of large off-shore implantable wind farms.

"ANA Holdings Green Bond" (Issued in October 2018) is world's first green bond issued by an air carrier. The funds are being used for the construction of a comprehensive training center with high environmental performance.

"Japan Railway Construction, Transport and Technology Agency Sustainability Bond" (Issued in May 2019) is the first sustainability bond certified by the CBI program in Asia (CBI: An International NGO to Promote Large-Scale Investments for a Low-Carbon Economy), and it was certified that the use of the fund is two-pronged: (1) Improvement of environment (Green) and (2) Solution of social issues (Social).

"Mitsui Fudosan Green Bond" (Issued in September 2019) is being used to refinance acquisition of a reserve floor for "Nihonbashi Muromachi Mitsui Tower", an environmentally friendly large-sized complex. The facility adopts environmentally friendly design and has high environmental performance; high thermal insulation and high performance glass, total heat exchanger, LED lighting, solar power generation equipment, etc.

"Kaneka Green Bond" (Issued in September 2019) is the first green bond issued by a Japanese chemical company, and the funds will be used for production facilities and R & D of PHBH ® (PHBH), a 100% plant-derived biodegradable polymer. In recent years, there has been growing concern that micro plastics floating in the sea may have an impact on the ecosystem and human health. To help solve the environmental pollution problem caused by disposable plastics, Kaneka began full-scale development of PHBH in 2009 and succeeded in putting it into practical use for the first time in the world.

"Japan Housing Finance Agency Green Bond" (Issued in October 2019) is being used to purchase the housing loan claims for new houses that meet Flat 35 S technical standards and are excellent in energy efficiency.

"Shimizu Corporation Green Bond" (Issued in December 2019) is being used to refinance the construction of energy-saving and environmentally friendly office buildings "Yokohama Grand Gate".

Partner(s)

International Capital Market Association

Obayashi Corporation, ANA Holdings, Inc., Japan Railway Construction, Transport and Technology Agency, Mitsui Fudosan Co., Ltd., Kaneka Corporation, Japan Housing Finance Agency, and Shimizu Corporation

Supplementary information

Press Release on October 25, 2019

Election to ICMA "Green Bond Principles Social Bond Principles Advisory Council"

https://www.nomuraholdings.com/news/nr/nsc/20191025/20191025.pdf

Nomura Holdings, Inc.

Environmental Management Policy (Long-Term Vision for Global Warming)

https://www.nomuraholdings.com/csr/environment/management.html

ANA Holdings became the world's first airline to accept green bonds on October 18, 2018

https://www.nomuraholdings.com/news/nr/nsc/20181018/20181018.pdf

Underwriting of Asia's first sustainability bond with CBI program certification issued by Japan Railway Construction, Transport and Technology Agency (JRTT) on May 23, 2019

https://www.nomuraholdings.com/news/nr/nsc/20190523/20190523.pdf

Underwriting of Green Bond issued by Mitsui Fudosan on September 6, 2019

https://www.nomuraholdings.com/news/nr/nsc/20190906/20190906_a.pdf

On September 6, 2019, Kaneka became the first Japanese chemical company to underwrite green bonds.

https://www.nomuraholdings.com/news/nr/nsc/20190906/20190906.pdf

Subscription for "Japan Housing Finance Agency Green Bond" issued by the Japan Housing Finance Agency, Independent Administrative Agency, on October 4, 2019

https://www.nomuraholdings.com/news/nr/nsc/20191004/20191004.pdf

Other Innovation Challenges

Strengthening ESD/SDGs related investment banking services through the establishment of “Nomura Greentech”

Nomura Holdings, Inc.

Similar Innovation Challenges

Challenge to build a finance mechanism towards the realization of a hydrogen-based society through the “Mirai Creation Fund” and “Hydrogen Utilization Study Group in Chubu”

Sumitomo Mitsui Financial Group, Inc.

Contributing to achieving net zero emissions through sustainable finance

Mitsubishi UFJ Financial Group,Inc

Contribution to a decarbonized society through Positive Impact Finance

Sumitomo Mitsui Trust Holdings, Inc.

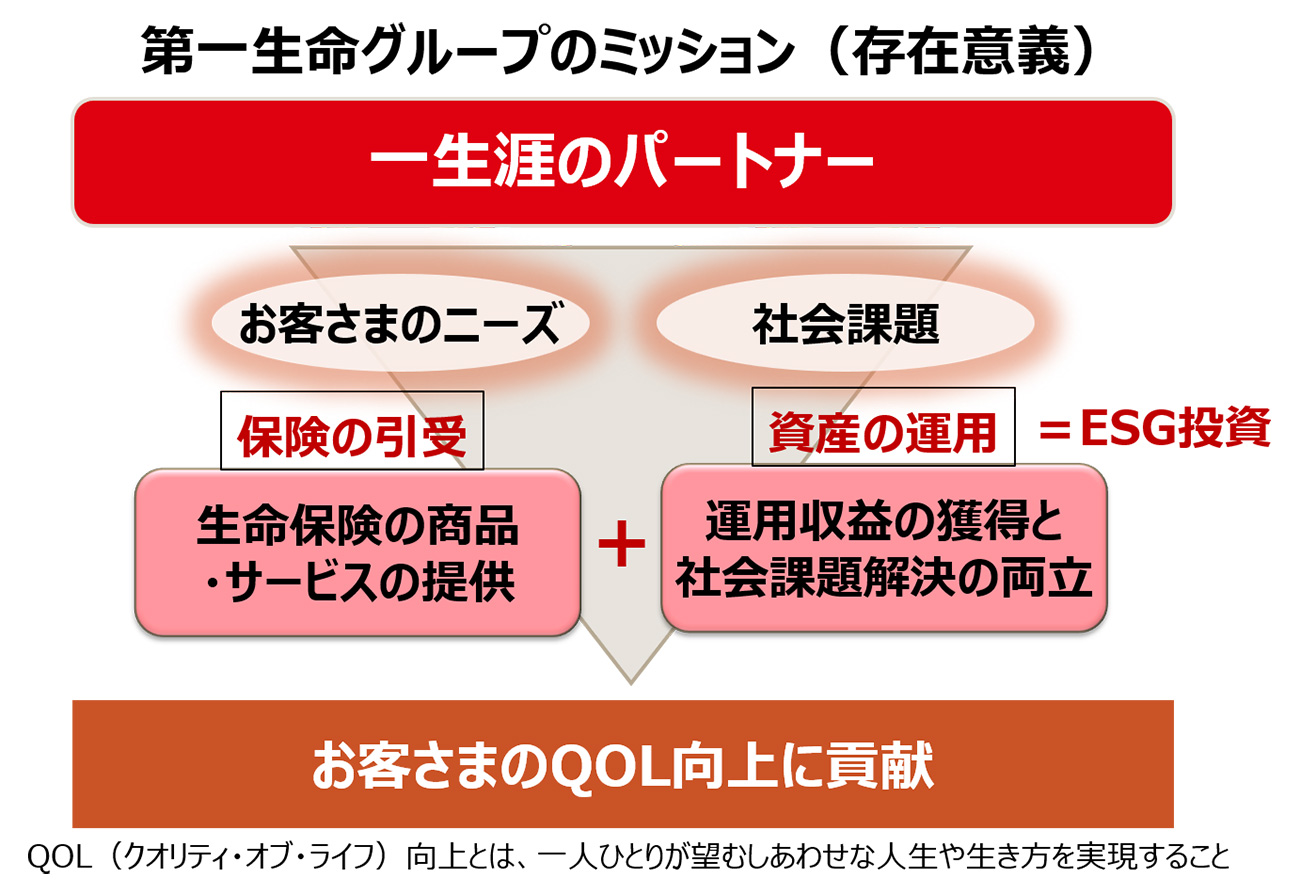

Contribution to the energy transition towards decarbonized society through ESG investment in "Dai-ichi Life way"

Dai-ichi Life Holdings, Inc.